The National Pensions Reserve Fund (NPRF) was established by the National Pensions Reserve Fund Act No 33 0f 2000 by the then Minister of Finance, Charlie McCreevy. Its intended purpose was to prepare for the ever-increasing pensions bill of the ever-increasing, but ageing, Irish population. The Act stipulated that at least one per cent of gross national product would be committed to the NPRF each year, in addition to the proceeds from the flotation of Eircom. The Act stipulated that there would be no withdrawals until 2025, when it was predicted the demand on the national pension scheme would peak.

This 2025 date was initially taken very seriously. In a 2002 election pledge, the Labour Party advocated using billions from the fund to build schools, hospitals and roads, for which it was accused by the other parties of not taking public and State pensions seriously. But Labour lost the election and the NPRF survived and flourished in the boom. Similarly, in 2008, despite the crash, when Minister for Finance Brian Lenihan signalled that he was reviewing payments to the fund due to the State’s mounting deficit, he promised that the fund would not be “raided” to prop up public finances. He pledged, “I don’t succumb to temptations like that.” Michael Somers, the NTMA chief executive at that time, added “future generations will thank us” for the foresight of maintaining “a big kitty”.

This tune changed less than a year later. In March 2009, the Government used emergency legislation to give €3.5 billion each to AIB and Bank of Ireland from the fund in exchange for ‘preference shares’. Again in 2010, an additional €3.7 billion was gifted to AIB, while on November 28th, the fund was further drained of €10 billion in order to prop up Ireland’s banks. There was no more talk of schools, hospitals and roads, no mention of a NPRF-funded stimulus and definitely no mention of the original plan of the pre-funding of public and private pensions.

From a total fund of almost €25 billion, just €4.2 billion remained in the NPRF at the end of 2010. At the time Laura Slattery of the Irish Times described its demise thus:

“The National Pensions Reserve Fund (NPRF), which has died aged nine from infanticide caused by multiple stab wounds, was born under the premise that it would prepare the Irish State for a pensions “time-bomb” due to explode in the decades ahead as Ireland’s population ages inexorably into an impoverished abyss.” (30 November 2010)

I would be nit-picking if I were to point out that infanticide can only happen if the victim is under a year old, thereafter it’s murder, because Laura makes a valid point – the fund that was created to ensure the payment of pensions in 2025 was no more in 2010.

This fund has apparently been “regrown” to approximately €20 billion, if Government reports are to be believed.

Hooray! Our pensions are secure, we cheer. Unfortunately not so – the word ‘pensions’ and the NPRF are no longer uttered in the same sentence. You are expected to look after your own pension now.

The Ireland Strategic Investment Fund (ISIF) was established on 22 December 2014 by the National Treasury Management Agency (Amendment) Act No 23 of 2014, which provided for its administration by the “reconstituted” National Treasury Management Agency, with a statutory mandate to invest on a commercial basis in a manner designed to support economic activity and employment in the State.

According to the ISIF’s website:

“The assets of the NPRF became assets of the ISIF on the ISIF’s establishment (except for assets governed by foreign law which remain NPRF assets until their transfer). €7.1 billion in the NPRF “discretionary portfolio” will be available for investment in accordance with the ISIF’s mandate as set out above. €13.3 billion in the NPRF’s “directed portfolio” will continue to be managed at the direction of the Minister for Finance.”

There is no indication as to how a paltry €4 billion in 2010 has grown to an alleged €20 billion in 2014, despite the recession.

The process of transferring all remaining NPRF assets to the ISIF is currently underway.

A worrying feature of the 2014 Act was its extremely wide import:

“to provide for the dissolution of the National Pensions Reserve Fund Commission, the National Development Finance Agency and certain committees; for those and other purposes to amend the National Treasury Management Agency Act 1990, the National Treasury Management Agency (Amendment) Act 2000 and certain other enactments and to repeal the National Pensions Reserve Fund Act 2000, the National Development Finance Agency Act 2002 and certain other enactments; to amend the State Authorities (Public Private Partnership Arrangements) Act 2002 and the Social Welfare Consolidation Act 2005 ; and to provide for related purposes.”

In other words, these billions of euros of public money, previously managed by a variety of bodies and earmarked for specific purposes (including social welfare projects, PPP projects, and enterprise finance), will now be controlled by one body, the National Treasury Management Agency (NTMA), reporting directly to the Minister of Finance. And who is the head of this body that now controls all our public monies?

Former stockbroker Conor O’Kelly will be paid a basic annual salary of €480,000, plus an €86,000 contribution, 18pc of his salary, to a defined contribution pension fund as chief executive of the NTMA. Mr O’Kelly will also be entitled to a non-pensionable, discretionary performance-related pay arrangement (a performance bonus – much loved by Irish Water and other quangos). He has been appointed for a five-year term.

Mr O’Kelly took over from John Corrigan when the latter retired on 4 January 2015. He is the former chief executive of NCB Group. In 2003 he led a management buyout of NCB, which was subsequently sold to Investec. Prior to joining NCB, where he was also Head of Fixed Income, Mr O’Kelly held senior management positions in investment banking with Barclays Capital in London, Tokyo and New York.

The irony is delicious. An ex-banker taking over a fund previously decimated by the banks.

And will the Ireland Strategic Investment Fund fare any better than the NPRF in its investment of public monies (our money)? To be frank, the signs are not promising:

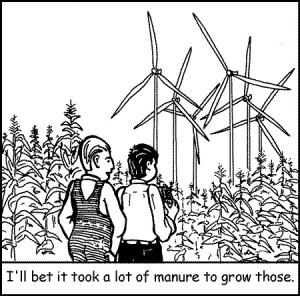

On 23rd December 2014 the Irish Examiner reported that the Mainstream Renewable Power Company (builders of industrial wind farms) would receive a capital injection of €60 million, and that “the National Pensions Reserve Fund, through BlueBay, will provide a substantial part of the funding while a number of “Irish high net-worth individuals and institutions” are also to invest through Cantor Fitzgerald”.

A number of questions need to be asked about this capital injection.

Firstly, where will this money be coming from if the NPRF is no more?

Secondly, assuming that the newspaper report should actually read that the money is coming from ISIF, how will this money fulfil the statutory obligation “to support economic activity and employment in the State”?

We already know that even with their free handouts in the form of subsidies and curtailment costs, renewable energy companies and industrial wind farms are taking a beating and recording record losses. How can these same companies support economic activity and create jobs?

Spain is a case in point. Indeed, if we are to learn from history and try and avoid the mistakes of others, Spain provides an ideal reference when we consider the establishment of government aid / public monies to the renewable energy industry. Apart from Ireland, no other country has given such broad support to the construction and production of energy through renewable sources. The Spanish government’s view was that massive public aid would generate many green jobs. With the supposed benefit of hindsight we can ask: to what extent and at what price?

“Contrary to expectations it appears that Spain has created a low number of jobs at great financial cost in terms of jobs destroyed elsewhere in the economy. Each green MW installed destroys 5.28 jobs on average elsewhere in the economy: 8.99 by photovoltaics, 4.27 by wind energy, 5.05 by minihydro. Spanish citizens must therefore cope with either increase of electricity rates or increased taxes ( and public deficit). Arbitrary State established price systems inherent to green energy schemes, leave the subsidized renewable industry hanging by a very weak thread and it appears doomed to dramatic adjustments that will include massive unemployment. These schemes create serious bubble potential as Spain is now discovering. In a recession period, the government cannot afford the subsidy cost and finally must penalize the artificial renewable industry which then faces collapse”.

Gabriel Calzada Álvarez PhD “Study of the effects on employment of public aid to renewable energy sources”, University of Rey Juan Carlos (November 2009).

When one considers that Ireland has already installed about 2000 megawatts of wind energy, and intends to almost double that again, that translates into the loss of a lot of jobs. A loss of jobs in the bloodstock industry, in the tourist industry, in the agricultural sector, in the food and drink industry – you name it, wind power will destroy it.

Similarly, economist Colm McCarthy warned against the proliferation of wind farms in 2013:

“The maximum demand on the Irish electricity system, recorded in 2010, was just over 5,040 megawatts. Demand has fallen since, and peak demand this year has been about 4,500 megawatts. Low demand (say at 6am on a fine summer’s Sunday) can be as low as 2,000 megawatts. Installed wind capacity is already approaching 1,800 megawatts, high relative to peak demand and too much to be used safely when demand is at the low end of the range.

An electricity system is potentially unstable if excessively reliant on unpredictable wind turbines, creating unacceptable risks of blackouts and damage to equipment. It is debatable whether Ireland needs any more wind turbines, additional to those already built and under construction. If the Government persists in its expansion plans, Ireland will have one of the highest ratios of wind to total capacity in the world, with electricity prices to match.”

(The Irish Independent 01/12/2013).

In December 2014, the National Competiveness Council of Ireland warned against promoting over-investment in new electricity generation capacity. The NCC, whose members include the heads of Google and Paypal in Ireland as well as several other employer and trade union representatives, said the focus of the electricity market should be on delivering new electricity for the cheapest possible cost.

These warnings, and many others besides, have gone unheeded, as evidenced by this latest injection of public monies into the wind industry. It is ironic that the source of public funding that was poured into the black hole of our collapsed banking system, is now being poured into the failing wind industry, very likely with the same result – the ordinary citizen ends up getting royally screwed.

.

We have already lost our pensions to the banks, now we can look forward to losing our jobs to the wind farms, whilst continuing to pay one of the highest electricity prices in the world. And the fat cats in the wind industry get fatter.

A post-programme country with a debt to GDP ratio of 123% and a current budget deficit of 5.7 billion euros – guess it makes sense to the folk who voted for the 2014 Act to invest our savings in adding a few more people to the unemployment register. Hard to see the logic though . . .

Never look for the logic Nigel – it will drive you mad. Rather seek out the ulterior motive: follow the money.

Reblogged this on Waterford Wind Aware League.

Reblogged this on Portlaw Against Turbines.

An article in the Irish Times of 29 December reports that the Department of Public Expenditure and Reform have suggested that, without changes and in the face of demographic pressures, the State could have to provide annual increases in funding of nearly €200 million in these areas up to 2026.

So we abolish the National Pensions Reserve Fund before Christmas, and express shock and horror at the incipient demographic pressures a week later.

See http://www.irishtimes.com/business/economy/cuts-to-state-pension-must-be-considered-1.2049998

Again, one wonders, where are are our national media to report on and highlight this impending disaster? Has the trade of journalism become irrelevant now that it comes down to concerned individuals and community groups to do the research and publish information to highlight all this corruption? Keep up the great work, Neil. It seems the professional journalists are either asleep at the wheel, or writing another opinion piece on Kim Kardashians’s backside!!

Thanks Dave. It might have something to do with the owner of those newspapers heavily investing in wind farms (and water meters). Just sayin’ …

Did my comment not reach your peer reviewed high standard? Or did it break your subjective civility rules? Or do you prefer only comments you like to hear? Funny how a South African lawyer seems to fit the profile of the Irish lawyers I detail in Section 5 of my first Report on Failte 32.

Hello Maurice

This is the first comment I have received from you so I am not sure how to respond! This blog is inactive now and so I do not monitor it anymore. Your entry finally made it into my inbox when I checked my Trash before emptying it.

Thank you for your reply Neil. I’m surprised you didn’t receive my original post. I have a screenshot of it if you can give me an email address (even a temporary one if you don’t want to give out your permanent one) and I’ll send to you. Anyhow, below is a copy that I had also copied and pasted text immediately after I posted. You will see it too, like my second follow up comment, stated that it is awaiting moderation. As regards your blog being inactive, well it is still visible and one can still use the reply feature, so one would reasonably believe that it’s still active.

Maurice D. Landers says:

Your comment is awaiting moderation. This is a preview; your comment will be visible after it has been approved.

October 31, 2023 at 12:37 pm

When I brought one of the groups I cofounded, Celtic Power Group, to Ireland seeking investment, I was told by the Irish Government that these types of wind farm investments are not government supported, and then shortly thereafter they practice just the opposite. What does this tell any rational person? The Irish Government just makes it up as they go along. No checks and balances in government to prevent this because they determine what the checks and balances will be. As the Garda Bureau of Fraud Investigation told me (I have it on tape), the Irish government can do what they like with the money (p.66, first Report). You have Irish politicians with their hands on billions of Euros (former NPRF) who can do what they like with it as they believe it’s theirs for the taking. It’s just sitting there doing nothing and the temptation is too great as it grows and grows. They just rename the agency/fund and then raid it. My reports on my website, Failte 32, refer in places to this renaming caper by the Irish government in other contexts. They then dole out the money secretly on a quid pro quo basis to their close associates. It’s almost impossible to trace. And they have it well sewn up in the very unlikely event that they get caught as Irish lawyers, oversight bodies, judges etc. protect them, and they’ve even fooled other countries into believing that Ireland has a solid business and legal/judicial system. You can only laugh at this stage. I don’t live in Ireland anymore and never will again so I’m no longer victim to this but if anyone comes across any illegal scheme by the Irish Government, please inform me or other US agencies. My contact info is at end of ‘Opportunity Ireland’ section on Failte 32. I’ve referred my case to many agencies here in the US inc. the SEC, FBI, DA and others. Nothing will change in Ireland from action within, that much I know for certain, but as I say in my Reports, we can avail of the oversight bodies and agencies of the US and other countries that can indirectly force some change. As for ever holding them accountable criminally, unfortunately this is just wishful thinking, but that said I do truly believe in karma…and wish for it in proportion.

Reply

Thank you for posting my original comment, Neil. I stand corrected when I stated above, “Funny how a South African lawyer seems to fit the profile of the Irish lawyers I detail in Section 5 of my first Report on Failte 32.”

No problem at all Maurice. At this stage it is water off a duck’s back. Best of luck with your endeavours to lift the lid on this simmering cauldron of corruption we call government.